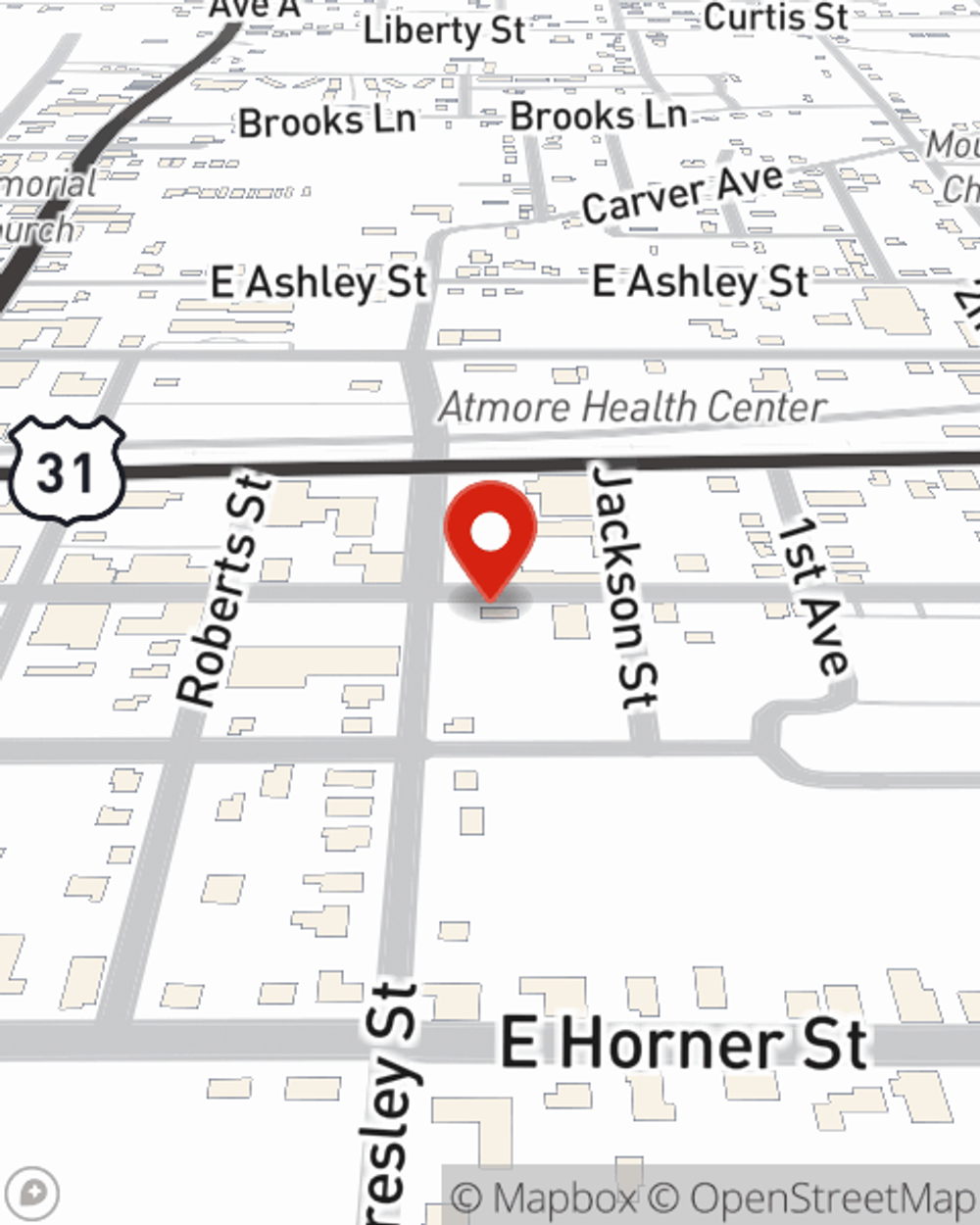

Condo Insurance in and around Atmore

Welcome, condo unitowners of Atmore

Insure your condo with State Farm today

- Atmore

- Flomaton

- Walnut Hill

- Davisville

- Perdido

- Century

- McDavid

- Monroeville

- Uriah

- Huxford

- Pollard

Your Search For Condo Insurance Ends With State Farm

Committing to condo ownership is an exciting decision. You need to consider cosmetic fixes home layout and more. But once you find the perfect townhome to call home, you also need fantastic insurance. Finding the right coverage can help your Atmore unit be a sweet place to call home!

Welcome, condo unitowners of Atmore

Insure your condo with State Farm today

Why Condo Owners In Atmore Choose State Farm

Your home is more than just a structure. It's a refuge for you and your loved ones, full of your personal items with both sentimental and monetary value. It’s all the memories you hold dear. Doing what you can to help keep it safe just makes sense! A next great step is getting a Condominium Unitowners policy from State Farm. This protection helps cover numerous home-related troubles. For example, what if a gas leak causes a fire or an intruder steals your tablet? Despite the aggravation or disappointment from the experience, you'll at least have some comfort knowing your State Farm Condominium Unitowners policy that may help. You can work with Agent Audrey Moon who can help you file a claim to help assist replacing your lost items. Preparing doesn’t stop troubles from crossing your path. Coverage from State Farm can help get your condo back to its sweet spot.

If you're ready to bundle or see more about State Farm's excellent condo insurance, get in touch with agent Audrey Moon today!

Have More Questions About Condo Unitowners Insurance?

Call Audrey at (251) 368-8191 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Audrey Moon

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.